How Much Deposit Do You Need as a First Home Buyer in Victoria?

Buying your first home in Victoria is exciting — but one question stops most people from taking the next step: “How much deposit do I actually need?”

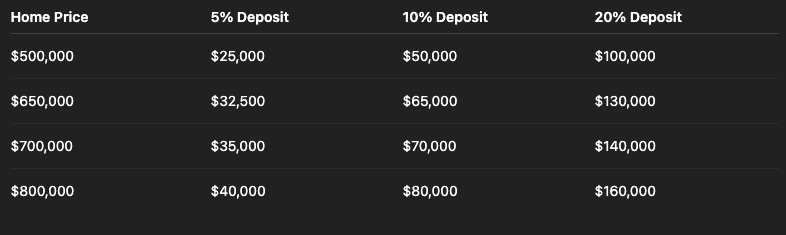

The short answer? Usually between 5% and 20% of the property price, depending on your lender, location, and whether you qualify for the Australian Government 5% Deposit Scheme.

Let’s break it down 👇

Minimum Deposit Requirements in Victoria

Most Australian lenders require a minimum 5% deposit to approve a home loan. However, deposits under 20% usually attract Lenders Mortgage Insurance (LMI) unless you qualify for the government’s 5% Deposit Scheme.

💡 Wizely Tip: A 20% deposit helps you avoid LMI — potentially saving $10,000–$20,000 depending on your loan amount.

Buy a Home with a 5% Deposit (No LMI)

From 1 October 2025, the Australian Government’s Home Guarantee Scheme (HGS) has been renamed the Australian Government 5% Deposit Scheme — but the benefits remain just as powerful for first-home buyers.

✅ Benefits of the 5% Deposit Scheme

Buy your first home with just 5% deposit

No Lenders Mortgage Insurance (LMI)

Available for both new and existing properties

Designed to help eligible Australians buy sooner and smarter

💲 Victoria’s Price Caps Under the 5% Deposit Scheme

Melbourne Metro: up to $900,000

Regional Victoria: up to $750,000

👉 Example: You could buy a $700,000 home with just $35,000 deposit, if eligible under the 5% Deposit Scheme.

Is a 10% Deposit Enough for a First-Home Buyer?

Yes — a 10% deposit is a great position for first-home buyers in Victoria. It shows strong savings discipline and can reduce your LMI premium while keeping you eligible for a wide range of lenders.

Even if you pay some LMI, buying sooner with a 10% deposit can often save you money compared to waiting years to save the full 20%.

Can You Buy a House with $10,000 Deposit?

It’s uncommon but possible under special conditions, such as:

Buying a very low-priced regional property, or

Combining savings with grants, stamp duty concessions, or gifted funds.

For most homes around $600k–$700k, aim for at least $30,000–$40,000 as a starting point to cover your deposit and upfront costs.

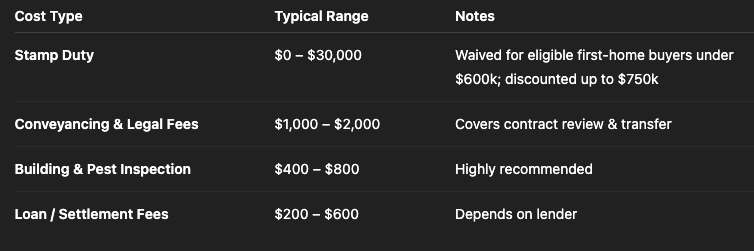

Extra Costs to Budget For

Many first-home buyers forget about additional costs when buying property. Here’s what to plan for:

✅ At Wizely, we calculate these costs upfront so there are no surprises at settlement.

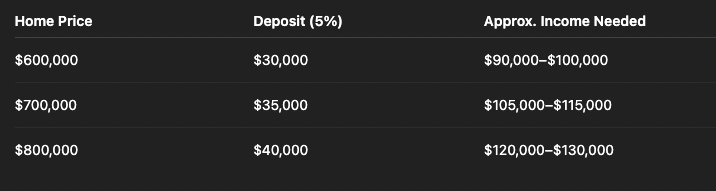

How Much Income Do You Need to Buy a Home in Victoria?

Your borrowing power depends on your income, expenses, and debts. Here’s a rough estimate for first-home buyers using a 5% deposit:

📊 Tip: Give us a quick call — we’ll calculate exactly how much you can borrow and which lenders fit your profile.

How to Avoid LMI Without 20% Deposit

You can avoid LMI even with a small deposit through:

✅ Australian Government 5% Deposit Scheme (formerly HGS)

✅ Professional LMI waivers (for doctors, accountants, engineers, etc.)

✅ Guarantor loans (where parents provide property equity as support)

Each lender has its own rules — a Wizely mortgage broker can find the best way for you to save thousands.

🧠 Wizely’s Smart Advice for First-Home Buyers

At Wizely, we help first-home buyers across Melbourne and Victoria:

Calculate how much deposit you really need

Check eligibility for the 5% Deposit Scheme

Access stamp duty savings & grants

Compare over 25+ lenders for the best rate and loan structure

Our goal: make your first home purchase simple, stress-free, and financially smart.

🚀 Ready to Buy Your First Home?

Buying your first home doesn’t have to feel overwhelming. Let’s calculate your deposit, scheme eligibility, and borrowing power together — so you can buy sooner.

🔍 Frequently Asked Questions

What is the minimum deposit for a first-home buyer in Victoria?

Most lenders require a 5% deposit, though a 20% deposit helps avoid LMI.

What is the Australian Government 5% Deposit Scheme?

It’s a program (formerly the Home Guarantee Scheme) that allows eligible first-home buyers to purchase a home with just 5% deposit and no LMI.

How much deposit do I need for a $700,000 house in Victoria?

A 5% deposit is $35,000, 10% is $70,000, and 20% is $140,000.

Can I buy a first home with a 10% deposit?

Yes — a 10% deposit is common, though you may need to pay a small LMI premium.

How can I avoid paying LMI in Victoria?

You can avoid LMI through the 5% Deposit Scheme, a guarantor, or certain professional LMI waivers.