Home Loan Melbourne: How to Find the Best Home Loan Rates and Brokers in Melbourne

This guide helps you navigate Melbourne’s competitive home loan market. It explains interest rates and factors affecting them, the benefits of using a specialised broker, and tips for first-home buyers and property investors. The article addresses challenges such as fluctuating interest rates, various fees, and a wide range of loan products. Its goal is to offer clear insights into competitive home loan rates, simplifying the process through brokers, and strategies to secure the best home financing based on individual needs.

The content is divided into several sections: current home loan rates, benefits of using a home loan broker, choosing the right home loan, securing home loans for first-home buyers, refinancing options, and special advice for property investors.

What Are the Current Home Loan Rates in Melbourne?

If you're searching for the most competitive home loan rates in Melbourne, it's important to understand what drives them. Rates are influenced by the Reserve Bank of Australia’s official cash rate, lender competition, and the features of different loan products.

As of May 2025, rates typically range between 5.19% and 5.78% p.a., varying based on whether the loan is fixed or variable, and the borrower’s financial profile.

These rates can fluctuate depending on broader economic conditions, inflation trends, and changes in credit policy. In strong economic periods, rates may rise, while in slower markets, lenders often reduce rates to stimulate borrowing. Whether you're a first home buyer, looking to refinance, or compare home loans, staying informed about current mortgage rates is essential.

How Do Melbourne Home Loan Rates Compare Across Lenders?

Banks and non-bank lenders offer different rates. Major banks usually provide lower base rates because of their stronger capital base, while non-banks may offer higher rates but with potentially more flexible features or lower fees. When comparing offers, consider the interest rate and overall cost of borrowing—including fees, repayment terms, and penalties.

Key comparison methods include: - Checking published rates on lender websites - Using independent online comparison tools - Reviewing customer feedback for hidden costs.

Melbourne’s competitive mortgage market means borrowers often have many options, and incentives like discounts for electronic statements may also be offered.

What Factors Influence Home Loan Rates in Melbourne?

There are several factors affect home loan rates:

- Economic Conditions: Inflation, unemployment, and economic growth forecasts.

- Loan Product Features: Differences between fixed and variable rates, offset accounts, redraw facilities, and split loans.

- Fee Structures: Arrangement, establishment, and ongoing service fees can affect the effective loan cost.

- Credit Profile: A borrower’s credit history and deposit relative to the property value (loan-to-value ratio) influence the risk premium added by lenders.

Lenders adjust rates based on these factors and may also be influenced by regulatory changes or government incentives such as first-home grants and stamp duty concessions.

How Can You Lock in the Best Home Loan Rate in Melbourne?

To secure a competitive rate:

- Compare Offers: Use online tools and consult independent mortgage brokers like Wizely.

- Rate Lock Options: Some lenders provide temporary rate locks while you complete the paperwork.

- Financial Stability: Improving your credit score and saving a larger deposit can help qualify you for lower rates.

- Market Timing: Monitor economic announcements and the Reserve Bank’s forecasts to time your application well.

For example, if signs suggest a decline in cash rates, negotiating or delaying your application may save thousands over the life of your loan.

Why Use a Home Loan Broker in Melbourne?

Home loan brokers bring specialised expertise and local market knowledge to simplify the borrowing process. They act as intermediaries between borrowers and lenders, saving time and often providing access to exclusive offers that may not be available to the public.

What Services Does a Melbourne Home Loan Broker Provide?

Brokers offer services such as:

- Assessing your financial health

- Comparing loan products

- Preparing and submitting loan applications

- Negotiating terms on your behalf

They also assist with gathering documents—from proof of income to property valuation reports—and explain the differences in loan features so you can make an informed choice.

How Does a Broker Help You Secure Competitive Home Loan Rates?

Brokers use their relationships with multiple lenders and deep understanding of market trends to help you secure lower rates. They may also have access to exclusive deals and promotional rates. By carefully reviewing your credit profile and borrowing needs, a broker can identify hidden fees and negotiate waivers that improve your loan’s overall terms.

What Are the Costs and Fees Associated With Home Loan Brokers in Melbourne?

Typically, brokers earn a commission based on the loan size, which often makes their service free for borrowers. In some cases, a small upfront fee may be charged for specialised advice. It is crucial to confirm any fee structure upfront and understand that any commission is usually offset by the long-term savings achieved through better loan terms.

How to Choose the Right Home Loan in Melbourne?

Selecting the best loan depends on matching the product’s features with your personal financial goals. There is no one-size-fits-all solution. For personalised support, feel free to contact us — we’re here to help.

What Types of Home Loans Are Available in Melbourne?

Common types include:

1. Variable Home Loans: Rates change with market conditions and may allow extra repayments without extra fees.

2. Fixed Home Loans: Offer a stable rate for a set period, providing predictability.

3. Split Loans: Combine fixed and variable rates to balance stability with potential savings.

4. Interest-Only Loans: Allow payment of only interest for a set period, which can help with cash flow.

5. Low-Deposit Loans: Target borrowers with smaller deposits; these may require mortgage insurance.

Each type has distinct benefits and trade-offs related to stability, flexibility, and cost.

How Do You Assess Loan Features and Conditions?

When evaluating loans, consider:

- Repayment Flexibility: Can you make extra payments or redraw funds?

- Interest Type: Fixed versus variable and how future rate changes may affect repayments.

- Loan Term: Shorter terms can mean higher monthly payments but lower overall interest costs.

- Penalty Fees: Charges for early repayment or refinancing.

Creating a comparison table to review these factors side by side can help reveal the true cost of different products.

What Are the Eligibility Criteria for Home Loans in Melbourne?

To qualify for a home loan in Melbourne, lenders typically look for:

- A deposit of 5% to 20% - A stable income history (usually at least 12 months)

- A strong credit score (commonly above 620)

- A favorable debt-to-income ratio (often below 50%)

- Evidence of regular repayments on existing debts

Additional documentation such as proof of identity and residency may also be needed. Mortgage brokers can help identify which profiles are most likely to be approved.

How Can First-Home Buyers Secure Home Loans in Melbourne?

First-home buyers face challenges like limited deposits and complex applications. However, proper preparation and support can greatly streamline the process.

What Government Grants and Incentives Are Available for Melbourne Buyers?

Programs such as the First Home Owner Grant (FHOG) and stamp duty concessions help reduce upfront costs for first-home buyers. These incentives, available in Victoria, can lower the deposit and other initial expenses, making home ownership more accessible.

How Do First-Home Buyers Improve Their Loan Approval Chances?

Strengthen your application by: - Maintaining a strong credit history - Reducing outstanding debt- Saving a larger deposit - Obtaining pre-approval to signal your commitment. Consulting a mortgage broker can also refine your application and help meet lender requirements.

What Are Common Challenges for First-Home Buyers in Melbourne?

Challenges include accumulating a sufficient deposit, managing high living costs, and understanding complex loan conditions. Careful budgeting, professional advice, and early market research can help overcome these challenges and secure favorable financing.

When and Why Should You Refinance Your Home Loan in Melbourne?

Refinancing means replacing your existing mortgage with a new one to achieve better terms. This can lower your interest rate, reduce monthly payments, or unlock home equity for further investments.

How Do You Know if Refinancing Is Right for You?

Consider refinancing if:

- Your current rate is significantly higher than market rates.

- Your credit profile has improved since your original loan.

- You have built substantial equity.

Evaluating your situation alongside professional advice will help determine if the benefits outweigh the associated costs.

What Are the Steps to Refinance a Home Loan in Melbourne?

The basic steps are:

1. Assess your financial situation and compare new rates.

2. Gather necessary documentation such as income proof and current loan statements.

3. Approach multiple lenders to collect offers.

4. Once an offer is accepted, complete the legal process of settling the old mortgage and registering the new one.

Keeping the process efficient helps minimise any extra fees or delays.

How Can Refinancing Save You Money on Your Melbourne Home Loan?

Even a small reduction (around 0.5%) in interest rate can lead to significant savings over the life of your loan. Refinancing may also consolidate high-interest debts and improve cash flow, contributing to long-term financial stability.

What Are the Benefits of Using Wizely for Your Home Loan?

Wizely offers a smarter, simpler path to home ownership and refinancing. Here’s how we help:

Expert Local Advice – We know the Melbourne property market inside and out, so you get insights that matter.

Personalised Loan Solutions – We tailor home loan options to suit your unique financial situation and goals.

Access to Multiple Lenders – Compare rates from a wide panel of banks and lenders, all in one place.

Save Time and Stress – We handle the paperwork, negotiations, and follow-ups — so you don’t have to.

No Cost to You – Our service is completely free for you. We’re paid by the lender once your loan settles.

Support for First Home Buyers – We simplify the process and explain everything in plain English.

Refinance with Confidence – We help you switch to a better deal and potentially save thousands.

Fast, Transparent Communication – We keep you updated at every step — no chasing, no jargon.

How Does Local Expertise Improve Your Home Loan Experience?

Wizely’s advisors understand local deposit requirements, property trends, and the lending landscape across Melbourne. This local insight allows us to tailor your home loan to align with area-specific conditions — helping you access competitive interest rates and flexible repayment options that suit your goals.

What Personalised Services Does Wizely Offer?

In-depth financial assessments and personalised home loan comparisons

One-on-one guidance to design the right loan strategy for your goals

Support with income verification, refinancing solutions, and understanding fees

Our tailored approach ensures your unique financial situation is at the centre of everything — helping you secure the right loan with less stress and more confidence.

How Does Wizely Simplify the Home Loan Application Process?

At Wizely, we take the stress out of securing a home loan. Our team handles the admin work for you — from paperwork to lender follow-ups — so the process moves faster and smoother. You’ll get real-time updates and personal support at every step, ensuring a clear, simple, and hassle-free experience from start to finish.

How Do Property Investors Secure Home Loans in Melbourne?

Property investors require specialised loan products that consider the unique risks of investment properties, such as rental income variability and maintenance costs.

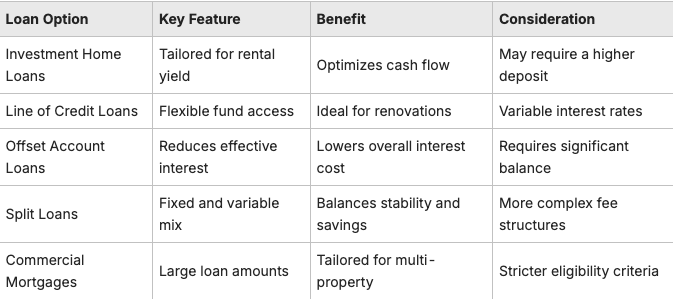

What Loan Options Are Available for Property Investors in Melbourne?

Investors can choose from:

1. Investment Home Loans: Structured for rental yield and may offer interest-only repayment options.

2. Line of Credit Loans: Provide flexible funding for renovations or portfolio expansion.

3. Offset Account Loans: Link a savings account to reduce the effective interest rate.

4. Split Loans for Investors: Combine fixed and variable rates for stability and potential savings.

5. Commercial Mortgages: Designed for larger property complexes requiring higher loan amounts.

Each option comes with different fee structures and potential tax implications.

How Do Lenders Assess Investment Loan Applications?

Lenders assess investment loan applications by reviewing:

- The borrower’s creditworthiness and experience in property management .

- Projected rental income and property value.

- Debt-to-income ratios and market conditions,

They require detailed documentation such as tax returns, bank statements, and sometimes business plans to ensure that only financially stable investors are approved.

What Are the Tax and Financial Considerations for Investors?

Investors should consider:

- Negative Gearing: Ability to deduct interest expenses from taxable income.

- Capital Gains Tax (CGT): Planning assets’ sale timing to manage tax liabilities.

- Depreciation Deductions: Claiming depreciation on property fixtures.

- Loan Interest Deductions: Ensuring proper record-keeping to deduct interest payments.

- Ongoing Fees: Application and service fees that affect net returns.

Consulting with financial advisors or tax professionals can help optimize these factors for long-term wealth accumulation.

Summary Table: Key Mortgage Elements for Investors

Below is a brief table summarizing options for property investors:

Frequently Asked Questions

Q: What current factors dictate home loan rates in Melbourne? A: They are influenced by the Reserve Bank’s cash rate, credit profiles, loan-to-value ratios, market competition, economic conditions, and regulatory changes.

Q: How can a mortgage broker help secure a better rate in Melbourne? A: Brokers compare multiple lender offers, negotiate fees, and access exclusive products using their local expertise.

Q: What is the importance of a rate lock clause when applying for a home loan? A: A rate lock secures the current rate for a set period, protecting you from market fluctuations during the approval process.

Q: Are government grants significantly beneficial for first-home buyers? A: Yes, grants like the First Home Owner Grant and stamp duty concessions help reduce upfront costs, easing access to the market.

Q: How does refinancing a home loan save money over time? A: By reducing interest rates, shortening the term, or lowering repayments, refinancing can save substantial amounts over the loan’s life.

Q: What documentation is typically required for a home loan application in Melbourne? A: Common documents include proof of income, credit history, identification, bank statements, property valuation, and deposit evidence.

Q: What tax benefits can property investors in Melbourne access with their home loans? A: Investors may benefit from negative gearing, interest expense deductions, depreciation claims, and strategic capital gains tax planning.

Final Thoughts

Melbourne's home loan market offers various products with competitive rates influenced by economic trends and lender strategies. This guide has provided an overview of current rates, the benefits of using a home loan broker, tips for choosing the right home loan, and tailored advice for first-home buyers and property investors. By leveraging professional insights and staying informed, borrowers can secure favorable mortgage conditions and achieve long-term financial stability.