Why More First-Home Buyers Are Entering the Property Market Sooner in 2026

For many Australians, buying a first home once felt like a distant goal. High deposits, rising prices, and upfront costs often delayed the decision for years.

Today, that mindset is changing. More first-home buyers are stepping into the market earlier than expected, supported by low-deposit lending options and clearer pathways to ownership.

The Changing Path to First-Home Ownership

Traditionally, buyers believed they needed a 20% deposit before even speaking to a lender. In reality, modern lending options have shifted the landscape.

Low-deposit solutions now allow eligible first-home buyers to:

Enter the market sooner

Reduce the time spent saving a large deposit

Buy with confidence while maintaining cash buffers

For many renters, this has turned home ownership from a long-term dream into a near-term plan.

Why First-Home Buyer Demand Is Increasing

Lower upfront barriers are directly influencing buyer behaviour.

Instead of waiting years, first-home buyers are:

Checking eligibility earlier

Securing pre-approval before inspections

Actively searching within defined price limits

Property Types Seeing the Most Interest

Entry-level houses

Townhouses and units

New and near-new builds

Homes priced within government scheme thresholds

This activity is increasing competition in affordable price brackets, particularly in growth corridors and established suburbs.

What This Means If You’re Planning to Buy

If you’re considering buying your first home, preparation matters more than ever.

Benefits for First-Home Buyers

Earlier access to property ownership

Lower deposit requirements

Clear borrowing limits

Reduced reliance on family support

Things to Consider

Strong competition for well-priced homes

Faster decision-making once the right property appears

Importance of correct loan structure upfront

Understanding your position before house hunting can save time, stress, and missed opportunities.

Why Pre-Approval Is More Important in Today’s Market

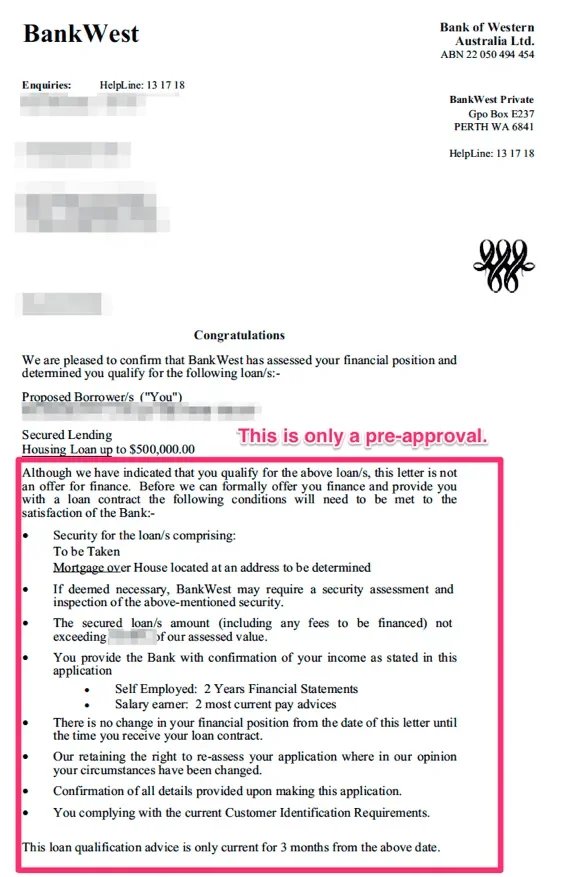

Example of an home loan pre-approval letter showing conditional approval details.

Pre-approval is no longer just a formality — it’s a strategic advantage.

Pre-approval helps you:

Know your true borrowing capacity

Focus on suitable properties only

Act quickly when opportunities arise

Avoid emotional or rushed decisions

Different lenders assess income, expenses, and low-deposit options differently, making professional guidance essential.

How Wizely Helps First-Home Buyers

At Wizely, first-home buyers are our core focus.

We support you by:

Reviewing your financial position clearly

Checking eligibility for low-deposit pathways

Comparing loans across 25+ lenders

Securing accurate, fast pre-approval

Guiding you from planning through settlement

Our goal is to help you move forward with clarity and confidence — not confusion.

Is Your First Home Closer Than You Think?

If you’re renting and unsure whether buying is realistic, a short review can make a big difference.

A simple conversation can help you understand:

How much deposit you actually need

What price range suits your situation

Your next steps toward home ownership

📞 Speak with us today — your local first-home buyer specialist

🌐 Book a free consultation and get clarity before you start house hunting